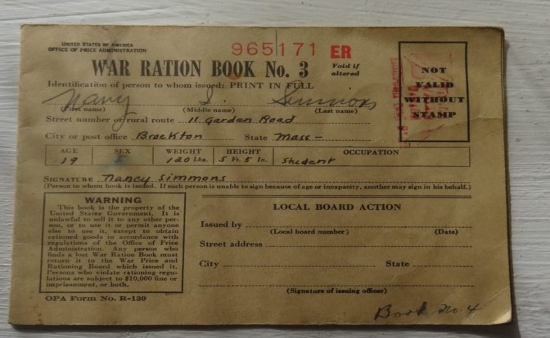

In the fast-paced rhythm of life, it's all too easy to overlook the quiet treasures that reside within our photo albums - the captured moments that weave the tapestry of our stories and the legacies we leave behind. As a dedicated photo organizing company, we understand the profound significance of preserving not just images, but the stories and memories they hold. Every photograph is a chapter in the narrative of our lives, a testament to the bonds we share and the moments that shape us.

Capturing the Essence of Estate Planning

As we strive to safeguard the essence of our legacy, we must also consider the practicalities of ensuring its preservation for generations to come. This is where estate planning becomes paramount - a vital component in protecting not only our assets but also the continuity of our stories and the well-being of our loved ones. Sponsored by the esteemed estate planner, Gita K. Nassiri, Esq., MBT, CPA, we present professional insights to harmonize the preservation of memories with the strategic planning of your estate.

Professional Tips for Securing Your Legacy

1. Review and Update Your Estate Plan: Take stock of your current estate planning documents and assess whether they accurately reflect your wishes. Collaborate with Gita K. Nassiri, Esq., MBT, CPA, to ensure your estate plan aligns with your evolving values and goals. Consider how your photo collection fits into your overall estate plan and make any necessary adjustments. Include provisions for the preservation and distribution of your photo collection, ensuring your legacy is passed down thoughtfully.

2. Notify Key Players: Communicate with those appointed in your estate plan, ensuring they understand their roles and responsibilities. Discuss the inclusion of instructions regarding the management of your photo collection in the event of incapacity or at death.

3. Check Trust Funding: If you have a revocable living trust, verify that it is adequately funded and includes provisions for your photo collection. Our team can assist you in organizing and cataloging your photos, making it easier to integrate them into your trust.

4. Update Beneficiary Designations: Review beneficiary designations on financial accounts and insurance policies, ensuring they reflect your current wishes.

5. Maintain Your Health Care Directive: Ensure your health care directive is up-to-date and that your designated agent understands your wishes.

By intertwining the preservation of memories with strategic estate planning, you not only protect your legacy but also provide your loved ones with a roadmap for the future. Let us guide you through this journey, ensuring your story endures with grace and resonance for generations to come.

For more information on creating or updating your estate plan, contact Gita K. Nassiri, Esq., MBT, CPA at 760.979.1280 or gita@capitallegacylaw.com.

Information in this article is intended for educational purposes only. It is not, nor should it be considered as legal or tax advice, and should not be relied upon as such.

You should consult your attorney or other tax professional to determine what is best for your individual needs.

Copyright � 2024 Gita K. Nassiri.